The Zillow Problem: Why Property Managers Should Worry

The Wake-Up Call

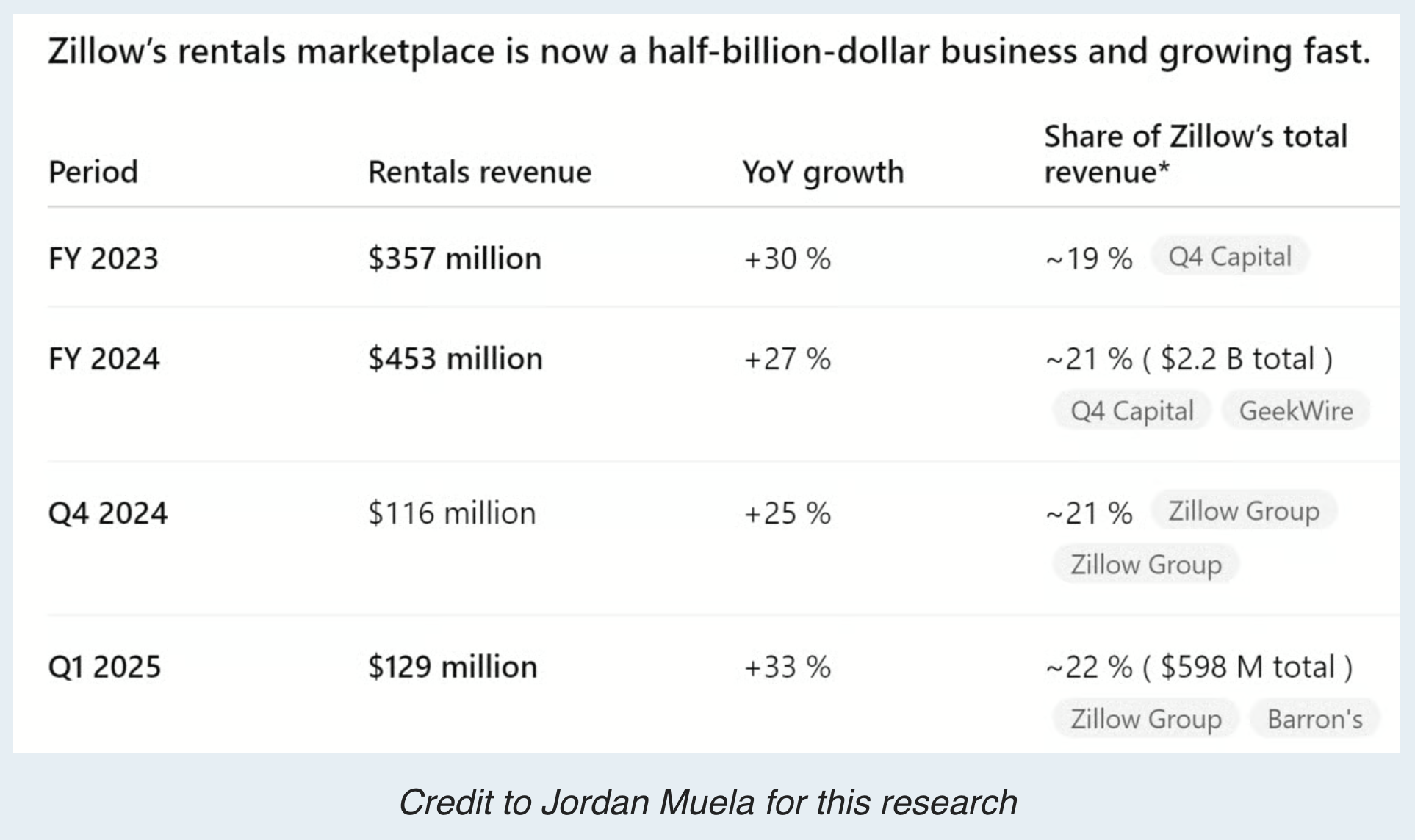

Zillow has quietly become the biggest existential threat to property management, and they don’t even manage a single property.

For years, most of us have focused on supply: finding new owners, signing more doors, and keeping our portfolios full. Demand (the renter side of the equation) always felt infinite. List a property, wait a bit, lease signed. Simple enough.

But while we were busy chasing new owners, Zillow was busy aggregating the attention of every renter in America. They built the default starting point for anyone looking for a home.

Here’s the thing: when one company controls where tenants look, they control the flow of demand. And when they control demand, they control us.

The question isn’t if this becomes a problem - it’s how fast.

Property Management as a Marketplace

At its core, a property management company is a small, local marketplace.

We sit between two groups: owners who supply housing and tenants who create demand for it. Our job is to keep that ecosystem balanced: healthy flow in, healthy flow out. It’s not that different from how Amazon connects buyers and sellers, or how eBay matches collectors with their next obsession. Both sides matter.

But let’s be honest, most of us have spent years obsessing over the supply side. We chase new owners, new doors, new contracts. Why? Because historically, demand felt infinite. List a unit, wait a little, and it eventually leased.

So we built our businesses around supply acquisition and stopped thinking about demand altogether.

And while we were focused on filling the top of the funnel, someone else was quietly aggregating all the eyeballs at the bottom.

How Zillow Took Over the Demand Side

The numbers tell the story: according to RentEngine’s Q1 leasing report, 60% of new leases now originate from a Zillow Network lead. And that number keeps climbing every month.

Ten years ago, leads came from everywhere: Craigslist, Facebook Marketplace, your own website, even a few niche listing sites. Today, those channels are ghosts. Zillow dominates rental listings visibility and tenant search traffic. When renters start looking, they don’t say “let’s check Craigslist.” They say, “Let’s check Zillow.”

How did that happen? Slowly, then all at once. Over the past decade, Zillow has acquired Trulia, HotPads, and every other platform that once competed for renter attention. They built an ecosystem so seamless that most renters never bother to look anywhere else.

They’re pulling an Airbnb: once you control the eyeballs, you control the rules.

Bottom line: Zillow owns the demand. Which means they now own us.

Why This Is an Existential Threat

Here’s the thing: Zillow doesn’t need to move fast to take control. They’re going to boil the frog slowly.

It starts innocently: monthly listing fees (already happening in many markets). Then, they’ll “standardize” the rental application (mandatory, of course). Next, say goodbye to tenant fees. Then credit checks. Then criminal background checks. Eventually, they’ll require their own lease, their own deposit terms, their own rent payment system.

Now, I’m not claiming to be a fortune teller here. I don’t know exactly how this plays out, and I’m not insisting every one of these changes will happen. But these are all valid concerns, and as an industry, we’d be smart to keep an eye on how much control we’re quietly giving away.

Sound far-fetched? Look at Airbnb. Hosts follow every rule because Airbnb controls the demand. Zillow’s playing the same long game. They just happen to be doing it for long-term rentals instead of weekend stays.

And here’s the irony: for renters, this future actually looks amazing. Transparent fees, consistent leases, faster applications. It’ll feel safer and simpler than ever.

But for property managers, it’s a slow erosion of independence. Every new policy tightens the noose.

Once a single company controls renter demand, they dictate the terms for everyone else.

That’s the Zillow Problem in one sentence.

Our Zillow Experiment (Real Data, Real Results)

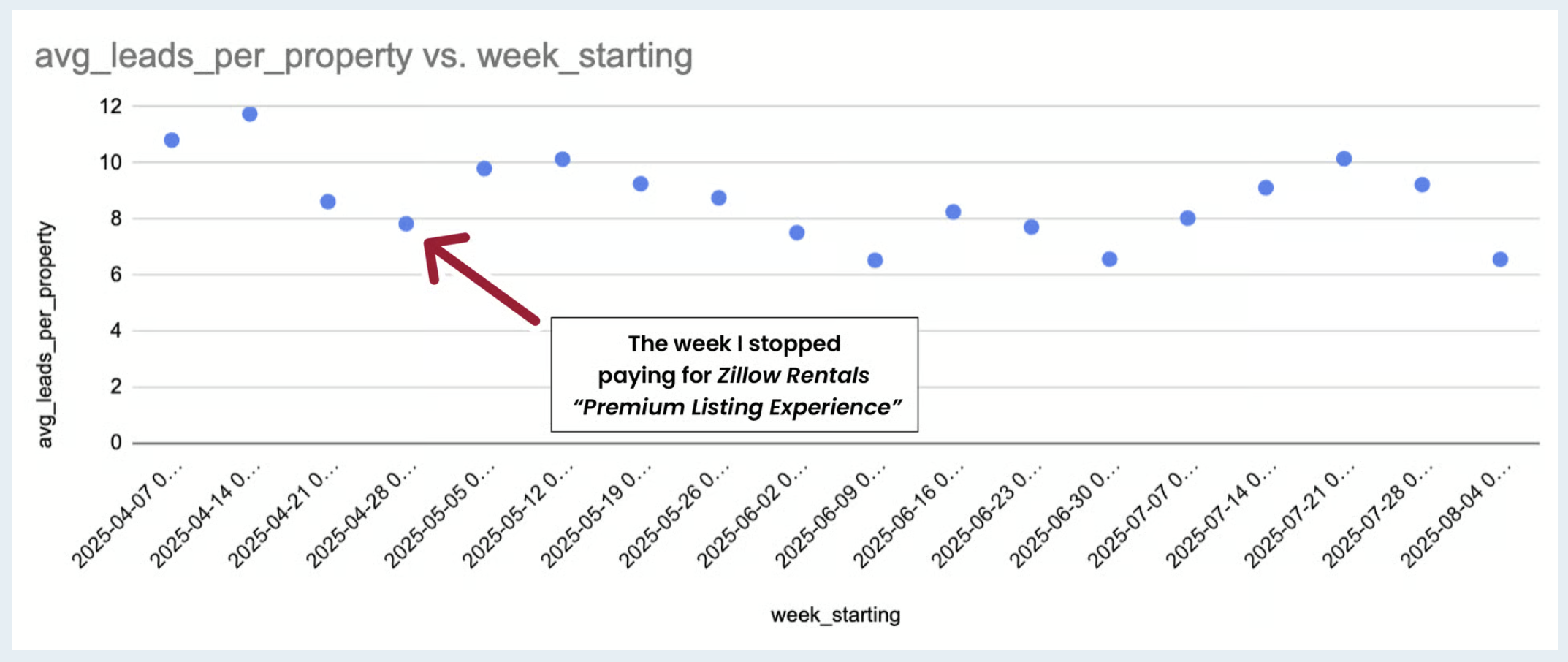

Earlier this year, we ran our own Zillow rental listings fees test. For three months during peak leasing season, we paid about $400 a month for Zillow’s “Feed Connect” upgrade - their premium listing option that supposedly boosts visibility and drives faster leases.

Then we turned it off.

Nothing changed. Our days on market stayed strong. Lead volume stayed the same. Roughly two-thirds of our rental inquiries still came from Zillow’s network, even on the free plan.

In other words, paying for “premium placement” made zero measurable difference. Zillow’s marketing might make you think you’re buying an advantage, but our data didn’t back that up.

And honestly, that’s $5,000 a year I’d rather spend on coffee for my leasing team than helping fund Zillow’s slow takeover of our industry.

So if you’re still paying Zillow for single-family rental listings, try turning it off for a month. Paying Zillow today is unnecessary. The bigger concern is what happens when “optional” becomes mandatory - and they’re the only game in town.

The Bigger Picture: Zillow’s Endgame

Zillow is effectively the largest property management company in America, with all the residents and none of the maintenance headaches.

They’ll keep the profitable parts: leasing, applications, rent payments. And they’ll leave us with the hard parts: maintenance calls, evictions, and upset owners.

This isn’t some sci-fi “Zillow takes over everything” scenario - it’s already happening, one feature rollout at a time. What we’re seeing is a Zillow monopoly in property management taking shape in slow motion.

Zillow’s not killing property managers directly; they’re just making our business model less profitable, less independent, and more dependent on them.

And that’s how control shifts: not overnight, but transaction by transaction.

What Can (or Should) Be Done?

I wish there were an easy fix. There isn’t.

In theory, we’ve got a few options: we could raise a pile of money and buy Zillow’s rental platform ourselves (unlikely). We could push for antitrust action (the FTC recently accused Zillow and Redfin of stifling competition), which at least proves regulators see the same risk. Or we could build a true competitor from scratch (that’s a big if).

None of these paths are simple or fast.

I don’t know the perfect solution. But I do know what happens if we do nothing: Zillow keeps tightening its grip until we’re just operating in their ecosystem instead of our own.

Bottom Line: Stop Funding the Takeover

Zillow quietly took over renter demand. That makes them our biggest competitor, and they don’t even manage a single property.

That’s why we stopped paying Zillow, and why I’m telling every property manager I know: stop funding the company that’s trying to eat your business model.

Run your own test. Pause your Zillow spend for a month and track your data. You might be surprised by what you find (or rather, what doesn’t change).

Because our lifeblood is renter demand. And right now, Zillow owns that lifeblood.

That should scare the hell out of us.

(watch my video on this topic below)