Security Deposit Alternatives & Tenant Screening Innovation

Security deposits and tenant screening are two fascinating areas of real estate that tech companies are attempting to disrupt. I thought it might be useful to provide an overview of activity in the space.

Security Deposit Alternatives

Traditional security deposits are starting to become passé in some jurisdictions. Renter’s Choice legislation, which forces property owners & managers to provide alternatives to the classic security deposit, is gathering steam nationwide and is already the law of the land in Atlanta, Cincinnati, and my home city of Columbus. Let’s examine the companies offering security deposit alternatives.

Overview of security deposit alternatives as compared to a traditional deposit

LeaseLock

LeaseLock, founded in 2014 by Derek Merrill, is a lease insurance product that replaces the traditional security deposit. It is currently aimed at larger apartment operators.

Under their “Standard” plan, the resident pays a fee of $29/month, and LeaseLock insures the owner against losses due to unpaid rent (up to $5,000) and damages (up to $500). Larger plans are available as well. There is no charge for the property owner. They only work with owners or managers with over 1,000 units right now.

No extra underwriting is required; any resident who is approved by the property is automatically approved by LeaseLock. Claims are paid out within 7 days and there is no on-site adjuster.

LeaseLock is notable for being a true insurance product. It’s not a surety bond or a rent guarantor. Derek wrote a great article where he discusses why they chose to go this direction, and why other security deposit alternatives don’t usually work. It’s well worth a read:

Failed Math: A Surety Bond Simulation

Rhino, TheGuarantors, and Jetty (Next-Gen Surety Bonds)

Rhino, TheGuarantors and Jetty each have a slightly different take on the traditional surety bond model. Surety bonds have been used as a residential deposit replacement since at least 2000, when Assurant insurance began selling them branded as SureDeposit. I’ll quote Assurant’s website here, which does a great job of explaining how a basic surety bond works:

SureDeposit is a surety bond. Under the surety bond, SureDeposit promises to pay the landlord in the event the resident does not uphold the financial obligations in the lease agreement or return the apartment in good condition. The resident is then required to reimburse SureDeposit for any damages, loss of rent and related expenses that SureDeposit paid to your landlord.

The three parties to a surety bond are:

OBLIGEE — Landlord

PRINCIPAL — Resident

SURETY — Insurance Company

The SURETY promises to pay the OBLIGEE in the event that a PRINCIPAL does not uphold his or her financial obligations.

SureDeposit is not insurance.SureDeposit is based on a simple concept: instead of requiring a full security deposit, the landlord can offer the residents the option to pay a modest one-time non-refundable payment for enrollment in the surety bond program. If the resident meets his/her financial obligations (i.e. paying rent and maintaining the leased property) they are under no further obligation to SureDeposit. If the resident does not meet their obligations, they are required to reimburse the Surety for the amount owed of their rental and financial obligations. Additionally, if the amount owed exceeds the bond amount (such as unpaid rent or damages), the resident will owe the landlord the excess amount. If no claim is made against the bond, the one-time bond payment covers the resident for the life of their residency in the participating community, no matter how many years they reside in the apartment.

It’s not clear to me how any of these companies have addressed the shortcomings of using surety bonds instead of security deposits, as outlined by LeaseLock’s Derek in his article linked above. None of them appear to be doing anything truly innovative except maybe running as “non-pooled.” Sure, they all have slick websites, portals and apps, and some of them allow monthly payments instead of large up-front fee. But I fail to see how that changes the underlying math. I’ll quote the beginning of Derek’s article here:

It’s no secret to multifamily that surety bonds have failed as a broad-based financial instrument to replace security deposits [1]. On its face, bonds are excellent at creating affordability and converting leases — creating “liquidity” as bond providers champion. A seductive proposition for sure. Yet the other half of the story remains — evaporated claims funds leaving properties exposed to bad debt.

Regarding all of these solutions, including LeaseLock, you might be wondering — what is the incentive of the resident to return the property in good condition, or to pay the last month’s rent? Doesn’t this whole arrangement create a moral hazard? With a normal security deposit, it’s common knowledge among the renting population that if you want your deposit back, you pay last month’s rent and return the property to the landlord clean and undamaged.

Enjoying This Article? Consider subscribing to my mailing list

What happens to tenants using one of these products if they don’t return the property in good condition, or don’t pay the last month’s rent? Although most of these companies claim to offer insurance, they can in fact go after tenants to be made whole if any claims are made against the policy. That is, if the landlord makes a successful claim for unpaid rent or damages, the insurance company can (and typically does) turn around and attempt to collect that money from the tenant afterward (LeaseLock told me it’s company policy that they don’t do this, even though they can per the agreement). This is not how most people understand insurance; imagine if your car insurance company attempted to get reimbursed by you after paying out a claim to another driver. What’s going on here is that although the tenant is making monthly payments, the landlord is actually the insured party.

Obligo

Obligo (founded 2017) is something else altogether. Their model is based on the familiar “credit card hold” used by hotels. When a prospective tenant applies to live at a property that uses Obligo, the company links the tenant’s bank accounts and credit cards to verify identity, income, and funds availability. If the resident is approved by both the property manager and Obligo (who does their own underwriting) and moves in, instead of collecting a security deposit, a “billing authorization” is created. This means that after the resident moves out, if the landlord makes a charge for unpaid rent or damages, Obligo can start collecting from the resident using those pre-existing bank account and credit card links. Obligo makes money by charging a variable fee, which can be paid by either the landlord or the tenant.

Obligo is not insurance and it is not a surety bond. It’s essentially a combination tenant screening app, credit product, and collections agency that does a lot of pre-authorization and verification before agreeing to backstop a future potential debt. It’s a very interesting and unique approach. Obligo takes great pains to make this entire arrangement very clear to tenants during the signup process. In theory this should align the incentives such that tenants would not be any more likely to skip rent or leave a damaged unit than they would be with a traditional security deposit.

Obligo’s signup workflow for the tenant

A traditional refundable security deposit functions a lot like a down payment on a house or car. It serves two primary functions:

Prove the credit-worthiness and liquidity of the borrower (tenant)

Provide some measure of protection from loss to the lender (landlord)

It’s not clear to me that there is in fact a problem with the classic security deposit instrument. If security deposit alternatives are going to become widely accepted alternative, they must find a way to provide the same functionality.

Additionally, all of these security deposit alternatives have two major drawbacks from the perspective of the tenant. One, the tenant may end up paying more in premiums over time (which are non-refundable and do not count toward any losses) than they would have paid with a normal security deposit. And two, the tenant loses access to the specifically-designed legal options that exist in most states to provide a streamlined and inexpensive process to dispute a security deposit. That said, these products do allow landlords a way to obtain more protection in states and local jurisdictions that set limits on security deposits.

Finally, both the tenant and the landlord must ask, what happens if these companies go belly-up in the middle of a lease? Jetty, by way of example, had to pause issuing policies during the 2020 pandemic and find a new reinsurer. What if they hadn’t found one?

Tenant Screening Innovation

First, I highly suggest reading this article I wrote about tenant screening in 2018:

What Actually Matters When Screening Tenants? Nobody Knows.

Now then, let’s see what’s being done about this problem, if anything.

Findigs

Findigs (founded 2018) is next-generation tenant application & screening company. They electronically link to an applicant’s financial accounts (bank accounts & credit cards) to verify income, identity, and detect fraud. They also make it easy to collect rent from tenants who prefer to pay using a bank account if their landlord doesn’t offer that option.

I’ve spoken with the owners of Findigs about their product on multiple occasions, and they have some truly innovative products coming later this year, built around tenant screening. Their ability to view up to 2 years of transaction data when a resident applies gives them some unique capabilities.

Vero & Savvy

Vero (founded 2017) and Savvy (founded 2019) appear to be very similar to Findigs in how they operate.

LandLord Verification

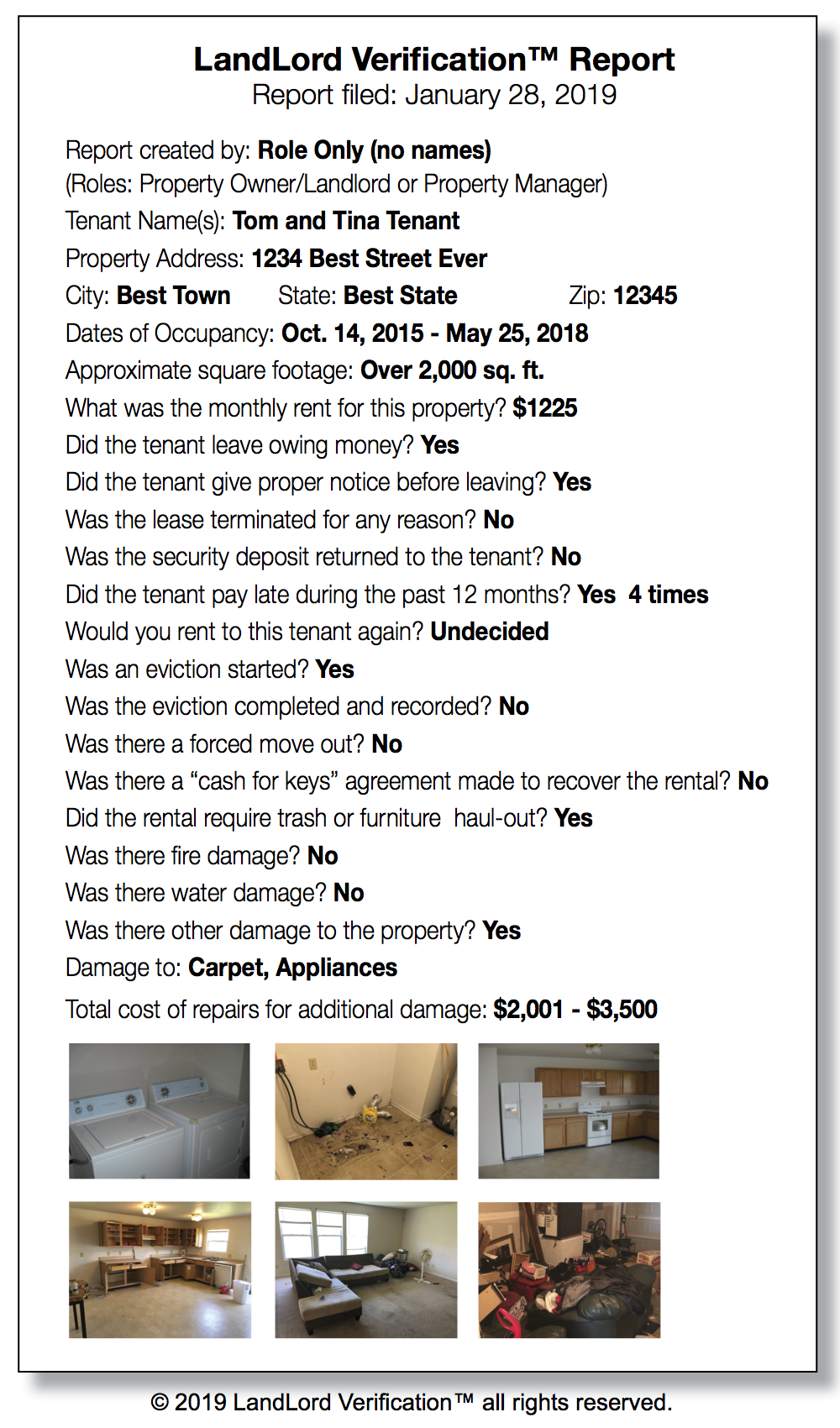

LandLord Verication (founded 2016) is the only company I know of attempting to build a nationwide rental history verification database. In this model, the tenant submits their rental history information to the company. LandLord Verification then reaches out to current and previous landlords to attempt to verify their occupancy dates, payment history, and more. Once confirmed, this information is stored in a database which is linked to the tenant. So in the future, rental history verification on that same tenant can be instantaneous.

LandLord Verification claims to have 66,500 verified landlords and property managers.

Sample LandLord Verification report

I believe there is a long way to go in improving tenant screening. I also believe more and more states will ban using credit scores or history when screening tenants (this has already happened in Minneapolis / St. Paul). Very little innovation is currently happening in this space.

For further reading:

Robots Are Taking Over (The Rental Screening Process)

Biased Algorithms Are Easier To Fix Than Biased People

I’m Peter Lohmann, CEO and founder of RL Property Management, a residential property management company located in Columbus Ohio. If you enjoyed this article, you can connect with me on Twitter, subscribe to my podcast Owner Occupied, or sign up for my mailing list.